France’s wine-growing market: perspectives and prospects

Panorama of the vineyard sector in France, an age-old patchwork of regions

France is the world’s second-largest wine producer, with just under 800,000 hectares of vineyards. Wine production accounts for 17% of the country’s total agricultural production(1).

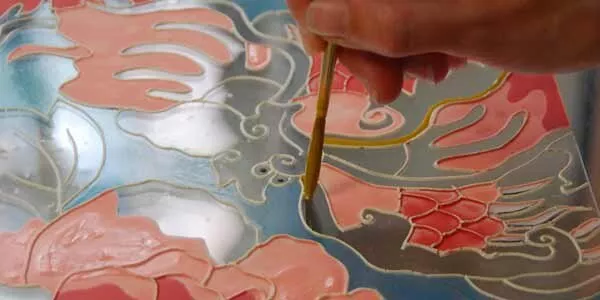

From the first harvests after the colonisation of the Western European region of Gaul by the Romans, to the meticulous viticulture traditions of the Cistercian monks in Burgundy, France’s wine-growing sector has evolved greatly over the centuries, and continues to dominate on a global scale to this day. This can be attributed to the diversity of its soil and techniques, and most notably to its grape varieties.

The regions vary substantially across the country. The largest of them, Languedoc Roussillon, spans 246,000 hectares, while the smallest, the Jura, measures just 2,000 hectares. Grape varieties are widely diverse (more than 200 authorised varieties and 20 dominant varieties)(2), some of which classified by appellation. Even terminology and units of measurement differ, such that a Bordeaux wine barrel or barrique is three litres smaller than a Burgundy wine barrel, commonly referred to as a pièce.

Evolution of the price per hectare: two major groups

Naturally, the price per hectare has also diverged over time in the different regions. We see two main groups. The first, making up around 80% of total vineyard surface area and including “generic” wines, has seen little to no change in price over the last 20 years, but not for lack of interest. A large part of the 9,400 vineyard transactions registered in 2021, representing 17,400 hectares and a record €1.1 billion, were from this first group(2).

The second group comprises all the protected designations or appellations of origin (AOP), and some of the smaller and more rare production regions. These appellations have seen their price per hectare increase steadily over several decades, with some rising three-fold, five- to ten-fold, and even higher.

Differences abound even within these two groups, apart from the price of the wines produced, which in the first group has remained generally low, while there is much variation in the second group.

In recent years, certain regions or appellations historically featured in the first group have started to move into the second group. This was the case for the Côte-Rôtie appellation, and more recently for Saumur Champigny, among others. Reasons for this trend include an improvement in the quality of wine produced, a handful of talented winemakers that have enhanced a region's prestige, or changes in consumer preference, as seen with the rise in popularity of rosé wine in Côte de Provence over the past few years.

A highly competitive market

Transactions start at close to €10,000 a hectare, and can rise to several million euros, with tens of millions of euros per hectare seen in some rare and exceptional cases, mainly in Burgundy. Vineyards valued at the average price per hectare attract little interest. In the Bordeaux region, where more than 3,000 hectares have been on the market, prices can be anywhere between €6,000 and €3 million per hectare. By contrast, the average price in Burgundy is €201,000, with some parcels or holdings (428 sq. metres) going for over €10 million a hectare(3).

In a highly competitive global market that, with new emerging players on the scene in recent years (US, South Africa, Chile, to name a few), the rise in the price per hectare can be problematic. For instance, some young wine-growers struggle to break into production regions, or contend with succession issues (conventional financing channels are not always available unless the wine farm unless can turn a profit in the short to medium term). This increase in the price per hectare also automatically raises the price per bottle, often making fine high quality wines unaffordable for everyday consumers. In parallel, fine wines can be subject to speculation at international level, particularly in Asia, which further pushes up prices in the prestigious vineyard market.

Although regulated, the vineyard market remains a free market and the trends observed in recent years continue despite efforts by SAFER( (Société d’aménagement foncier et d’établissement rural)(4), and the introduction of a new law to regulate access to agricultural land through company structures and potential pre-emptions rights. Demand for tangible assets, the need for diversification, and a keen interest in this type of investment are some of the factors that driving this market.

Multiple challenges for the sector

Many more challenges lie ahead for the sector. Starting with climate change, which will undoubtedly spur changes; new appellation specifications; the introduction of new more adapted grape varieties; changes in irrigation policies; and changes in consumer behaviour (already at play), including demand for lighter wines that are lower in alcohol, etc.

The partial or full conversion of estates to more eco-friendly techniques is, and will continue to be, a key issue. Today, just 14%(5) of wineries produce organic wine, but a transition is in motion. This is also is a criterion that would increase the price of a transaction.

Grapevines have been on the planet for six million years, and cultivated by humans for several thousand of those years. Despite the changes to come, they will adapt… just as we are!

(1) Source : https://agriculture.gouv.fr/infographie-la-viticulture-francaise - sources de l’infographie : FranceAgrimer.fr, Agreste graphagri 2020. Données 2019 sauf indication contraire. Mars 2022.

(2) Source : SAFER – L’essentiel des marchés ruraux 2021

(3) Source : SAFER - https://www.le-prix-des-terres.fr/carte/vigne/

(4) A non-profit whose mission includes adapting production structures in agriculture and forestry, promoting these activities among young people, protecting the environment, landscapes and natural resources, and supporting local economic development..

(5) Source : https://www.vitisphere.com/actualite-92784-la-mise-au-point-des-vignerons-de-champagne-bio.html

Would you like to discuss this subject further with us?

WARNING

This document is an advertisement and has no contractual value. Its content is not intended to provide an investment service, nor does it constitute investment advice or a personalized recommendation on a financial product, nor insurance advice or a personalized recommendation, nor a solicitation of any kind, nor legal, accounting or tax advice from Société Générale Private Banking France.

The information contained herein is provided for information purposes only, is subject to change without notice, and is intended to provide information that may be useful in making a decision. The information on past performance that may be reproduced does not guarantee future performance.

Before subscribing to any investment service, financial product or insurance product, the potential investor (i) must read all the information contained in the detailed documentation for the service or product in question (prospectus, regulations, articles of association, key investor information document, term sheet, information notice, contractual terms and conditions, etc.), in particular those relating to the associated risks; and (ii) consult his legal and tax advisors to assess the legal consequences and tax treatment of the product or service being considered. His private banker is also at his disposal to provide him with further information, to determine with him whether he is eligible for the product or service envisaged, which may be subject to conditions, and whether it meets his needs. Consequently, Société Générale Private Banking France cannot be held responsible for any decision taken by an investor based solely on the information contained in this document.

Predictions about future performance are based on assumptions that may not materialize. The scenarios presented are estimates of future performance, based on past information about how the value of an investment varies and/or current market conditions, and are not exact indications. The return obtained by investors will vary depending on market performance and the length of time the investor holds the investment. Future performance may be subject to tax, which depends on the personal circumstances of each investor and is likely to change in the future.

For a more complete definition and description of risks, please refer to the product prospectus or, if applicable, other regulatory documents before making any investment decision.