Understanding art price indices

How are art price indices constructed and what are they for? Laurent Issaurat, Head of Art Banking at Societe Generale Private Banking, spoke to expert Jean Minguet, Head of Econometrics at Artprice. A subsidiary of Artmarket.com, Artprice is a world leading database of art listings and indices (paintings, stamps, drawings, sculpture, photographs, etc.).

Laurent Issaurat: How does Artprice construct its price indices?

Jean Minguet: The role of an index is to show how prices have evolved over a given period. In the art world, an index must always be applied to an ensemble of works that is sufficiently homogeneous for the exercise to have any meaning. This could be a particular art form, like sculpture, a particular movement, like impressionism, or the works of a specific artist in order to track how their prices have evolved.

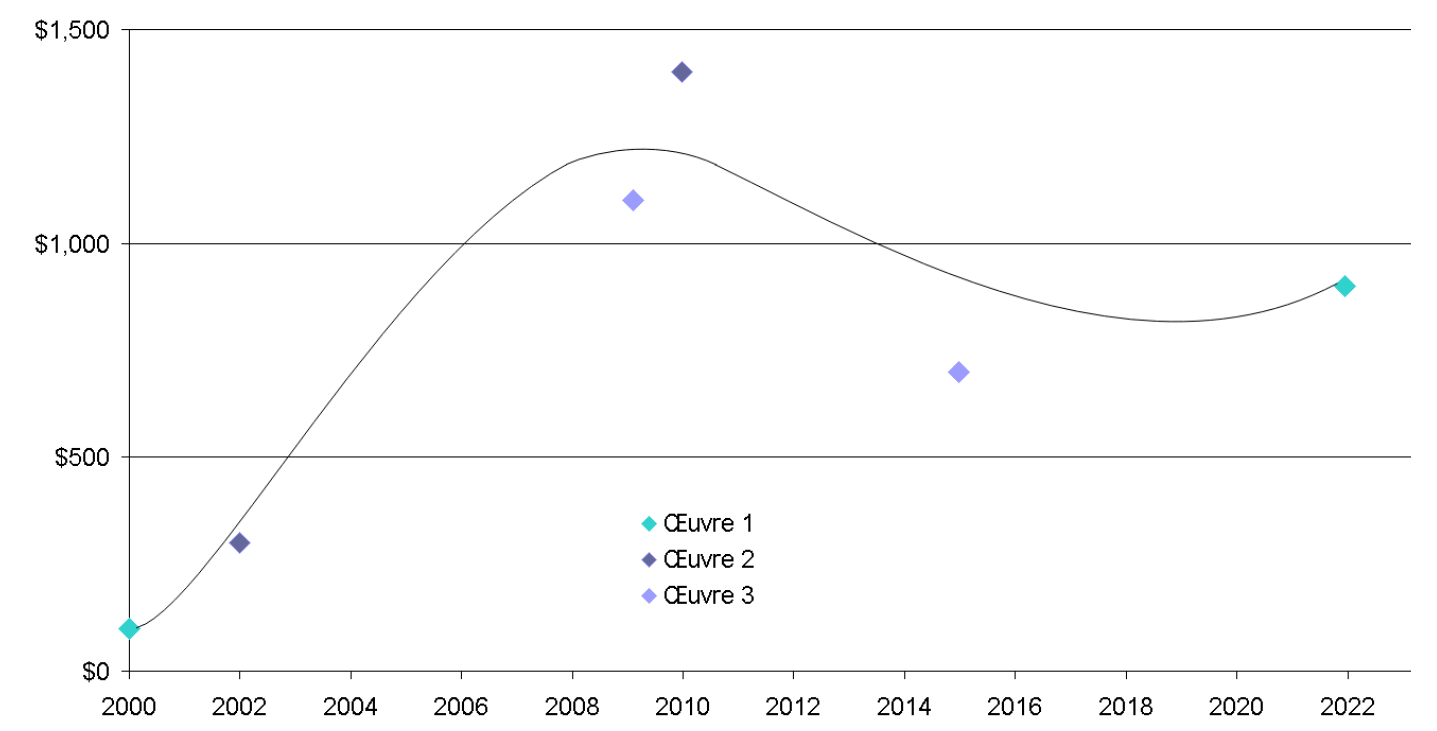

There are several methods for constructing indices on the art market, the most solid of these without a doubt being the “repeat-sales method”. The first step of this method is to identify within a defined homogeneous set of artworks all those that have been sold at least twice at auction over a given period. This allows us to observe how very specific prices for equally specific works have evolved. Once enough pairs of results have been collected over the full period, we can then calculate the curve that best tracks their progression. The repeat-sales method was developed by university researchers, alongside a second, fundamentally different approach called the “hedonic method”, which models the influence of a set of criteria (size, technique, year of creation, theme, etc.) on the price of each piece, in order to estimate the influence of time.

Laurent Issaurat: Which of these methods do you use at Artprice?

Jean Minguet: We prefer the repeat-sales method. It requires more results but it is far more direct as it does not depend on an underlying model. To increase the number of viable pairs of results, it is possible to form additional pairs by identifying similar works: for example, two lots from the same artist, of the same size and the same year, using the same technique, with roughly the same title. It is a sound assumption at scale and provided that all the works are taken into account methodically.

Laurent Issaurat: How is a price index useful to owners, buyers, and sellers of art?

Jean Minguet: The biggest draw of this tool is the overview it gives of price trends: when prices went up, when they came back down, and the extremity of these movements. This kind of information is crucial for anyone wanting to understand and get into the market. Again, a price index is a tool for reading the market and looking at the influencing factors at play.

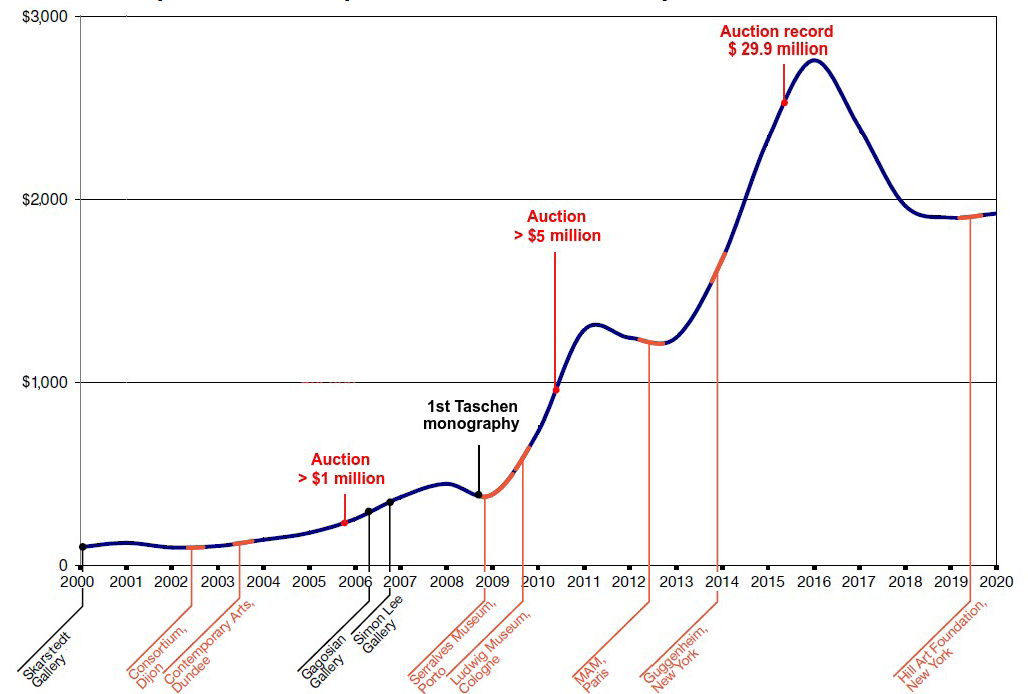

Case in point: a price index tracking the work of a particular artist. It must always be put into perspective with the artist’s career which can affect their popularity. Let’s say the artist produces a new series of work. It is exhibited at a prestigious gallery, is included in an exhibition or biennale, a monograph is published, etc. The price index will prove an excellent tool for tracing the artist’s career and observing how the market has responded to various events and stimuli.

Laurent Issaurat: Can you give us an example?

Jean Minguet: Based on the price index calculated for the standalone pieces (paintings and drawings) of the artist Christopher Wool, for example, we can ascertain that between 2000 and 2016 prices overall have increased by a factor of nearly 30. But that's not all. The curve also reflects the influence of the Gagosian and Simon Lee gallery exhibitions, as well as Wool’s solo exhibitions in Porto, Cologne, and Paris, before the consecration of his work at the Solomon R. Guggenheim Museum in New York.

It is always interesting to compare a price index with the price an actual piece. Christopher Wool’s Untitled (1990, alkyd and graphite on paper), bought for US$35,000 in May 2000, was sold for US$ 2.4 million in May 2015. In the spring of 2018, it went back under the hammer with an estimated value of US$2.5 - 3.5 million. However, biddings did not reach the reserve price, which was probably around US$2 million. The track record of the work supports Artprice’s index. Tracking the evolution of the same shape as the index curve very clearly illustrates the value accretion of Wool’s work between 2000 and 2015, before a slight contraction between 2015 and 2018. The variation of its price even exceeds the price of Christopher Wool’s entire collection of paintings and drawings between 2000 and 2015 (the work may have sold particularly well) before going down again.

Laurent Issaurat: Is the artist’s background considered when estimating their trajectory on the market?

Jean Minguet: A price index does not dispense with delving into the personal history of an artist, getting to know their work, their life, their technique. Ultimately, this knowledge is how we decipher the price index. Moreover, it is used to determine the most homogeneous ensemble of work possible for the purposes of calculation. All told, a price index provides information that supplements standard expertise by giving an evaluation of the market. But there is always a lot more to it than that.

Laurent Issaurat: What other data needs to be included?

Jean Minguet: From a purely economic perspective, there are other factors like the liquidity of works — or the balance between supply and demand. To establish how rare an artist’s works are, and how many potential buyers there are, several indicators needs to be analysed: the number of lots sold, the ratio of unsold work, the percentage of lots that exceeded estimates, and the recency of the latest price record. Another important factor is to understand the market structure of each artist, and in particular their geographic distribution. Some masterpieces only go to auction once or twice a year, only in New York and London, while other artists have a very localised or regional market, with only a few auction houses used to selling their work. Of course, none of this information in included in price indices.

Laurent Issaurat: What do the price indices tell us about the trends on the art market over the next 20 to 30 years?

Jean Minguet: I cannot emphasise enough how important homogeneity is when calculating the price index of an ensemble of work. That said, it is possible to study the overall price trends of the art market as a whole.

Artprice does this every quarter and publishes the results for free. We call these the Global Indices. Among other things, the Global Indices offer an interesting comparison between the main segments of the art market by providing a breakdown by medium and by period of creation. Of note, the indices reveal that the last 25 years of post-war art and contemporary have outperformed earlier periods. Which is not all that surprising, considering that it was mainly for the artists of these periods that value began to appreciate in the early 21st century, in step with their careers and as the art market gradually gained recognition. Christopher Wool, whom I mentioned earlier, is one such artist.

But this rise in value has slowed in recent years. In-depth research have shown that many contemporary artists (born after 1945) have now reached the peak of their fame. There are but a few still being discovered, particularly among the ultra-contemporary artists (under 40) who are driving price growth. Yet more and more smaller works are making the rounds on the art market, such as prints and multiples by Jeff Koons, Banksy, or Yayoi Kusama, which were not traded as frequently before and which, in a way, dilute the rise in prices. As academic research shows, the value of the most beautiful works usually appreciates faster and more substantially than for other works — a phenomenon known as the Masterpiece Effect.

Would you like to discuss this subject further with us?

GENERAL DISCLAIMER :

Societe Generale Private Banking is the business line of the Societe Generale Group operating through its headquarters within Societe Generale S.A. and through departments, branches or subsidiaries, located in the territories mentioned below, acting under the brand name "Societe Generale Private Banking" and distributing this document.

This document, which is of an advertising nature, has no contractual value. Its content is not intended to provide an investment service, nor does it constitute investment advice or a personalized recommendation on a financial product, nor insurance advice or a personalized recommendation, nor a solicitation of any kind, nor legal, accounting or tax advice from any entity under the responsibility of Société Générale Private Banking.

The information contained herein is provided for information purposes only, is subject to change without notice, and is intended to provide information that may be useful in making a decision. The information on past performance that may be reproduced in no way guarantees future performance.

The private bankers of Société Générale Private Banking entities are at the disposal of potential investors to provide them with further information on the variations, within the Société Générale Private Banking entity concerned, of the themes presented in this document.

This document is confidential, intended exclusively for the person consulting it, and may not be communicated or brought to the attention of third parties, nor may it be reproduced in whole or in part, without the prior written consent of the Société Générale Private Banking entity concerned.

No Société Générale Private Banking entity may be held liable for any decision taken by an investor solely on the basis of the information contained in this document.

Société Générale Group maintains an effective administrative organization that takes all necessary measures to identify, control and manage conflicts of interest. To this end, Societe Generale Private Banking entities have put in place a conflict of interest policy to manage and prevent conflicts of interest. For more details, Societe Generale Private Banking clients can refer to the conflict of interest policy available on request from their private banker.

Societe Generale Private Banking has also implemented a client complaint handling policy, which is available on request from their private banker or on the Societe Generale Private Banking website (www.privatebanking.societegenerale.com).

SPECIFIC WARNINGS BY JURISDICTION

France: Unless expressly stated otherwise, this document is published and distributed by Société Générale, a French bank authorized and supervised by the Autorité de Contrôle Prudentiel et de Résolution, located at 4, place de Budapest, CS 92459, 75436 Paris Cedex 09, under the prudential supervision of the European Central Bank ("ECB") and registered with the ORIAS as an insurance intermediary under the number 07 022 493 orias.fr Societe Generale is a French société anonyme with a capital of EUR 1,010,261,206.25 as of February 1, 2023, whose registered office is located at 29, boulevard Haussmann, 75009 Paris, and whose unique identification number is 552 120 222 R.C.S. Paris. Further details are available on request or at www.privatebanking.societegenerale.com.

Luxembourg: This document is distributed in Luxembourg by Société Générale Luxembourg, a société anonyme registered with the Luxembourg Trade and Companies Register under number B 6061 and a credit institution authorized and regulated by the Commission de Surveillance du Secteur Financier ("CSSF"), under the prudential supervision of the European Central Bank ("ECB"), and having its registered office at 11, avenue Emile Reuter - L 2420 Luxembourg Further details are available on request or at www.societegenerale.lu. No investment decision whatsoever should be made solely on the basis of this document. Société Générale Luxembourg accepts no responsibility for the accuracy or otherwise of the information contained in this document. Societe Generale Luxembourg accepts no responsibility for any actions taken by the recipient of this document solely on the basis of this document, and Societe Generale Luxembourg does not represent itself as providing any advice, in particular with respect to investment services. The opinions, views and forecasts expressed in this document (including its annexes) reflect the personal views of the author(s) and do not reflect the views of any other person or Société Générale Luxembourg, unless otherwise stated. This document has been prepared by Société Générale. The CSSF has not carried out any analysis, verification or control on the content of this document.

Monaco: This document is distributed in Monaco by Société Générale Private Banking (Monaco) S.A.M., located at 11 avenue de Grande Bretagne, 98000 Monaco, Principality of Monaco, regulated by the Autorité de Contrôle Prudentiel et de Résolution and the Commission de Contrôle des Activités Financières. Financial products marketed in Monaco may be reserved for qualified investors in accordance with the provisions of Law n° 1.339 of 07/09/2007 and Sovereign Order n° 1.285 of 10/09/2007. Further details are available on request or on www.privatebanking.societegenerale.com.

Switzerland: This document may constitute advertising within the meaning of the Law on Financial Services ("LSFin"). It is distributed in Switzerland by SOCIETE GENERALE Private Banking (Suisse) SA ("SGPBS" or the "Bank"), whose registered office is at rue du Rhône 8, CH-1204 Geneva. SGPBS is a bank authorized by the Swiss Financial Market Supervisory Authority (FINMA). This document may in no way be considered as an investment advice or recommendation by SGPBS. The Bank recommends obtaining professional advice before acting or not acting on the basis of this document and does not accept any liability in connection with the content of this document. Financial instruments, including in particular units in collective investments and structured products, may only be offered in accordance with the LSFin. Further information is available on request from SGPBS or at www.privatebanking.societegenerale.com.

This document is not distributed by SG Kleinwort Hambros Bank Limited in the United Kingdom, nor by its branches in Jersey, Guernsey and Gibraltar, which together operate under the brand name "Kleinwort Hambros". Accordingly, the information provided and any offers, activities and financial and asset information presented do not relate to these entities and may not be authorized by these entities or appropriate in these jurisdictions. Further information on the activities of Societe Generale's private banking entities located in the United Kingdom, the Channel Islands and Gibraltar, including additional legal and regulatory information, is available at www.kleinworthambros.com