The origins of Societe Generale

The Societe Generale pavilion during the Universal Exhibition of 1900 at the foot of the Eiffel Tower, the construction of which was partially financed by the bank.

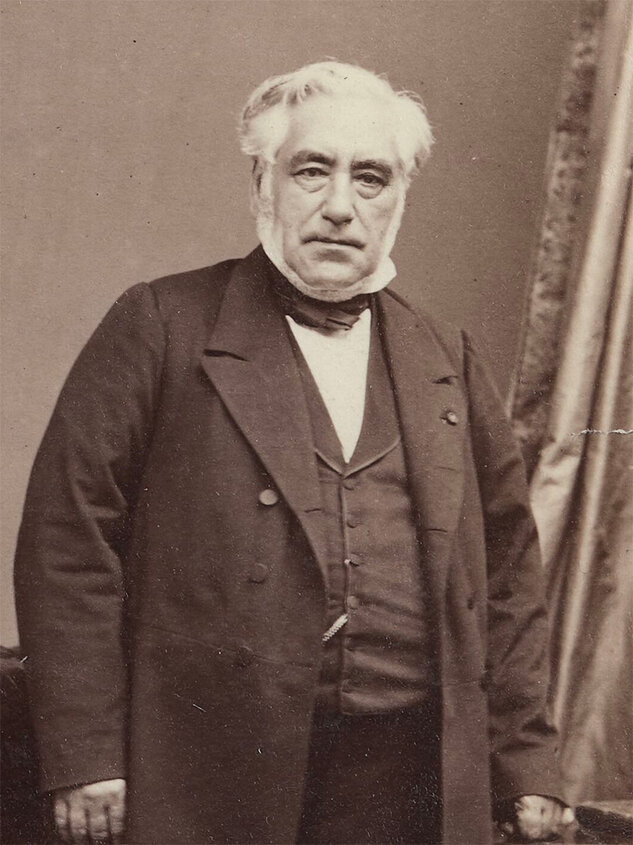

The founders of Societe Generale, Edward Blount, Paulin Talabot and Joseph-Eugène Schneider.

2024 marks the one hundred and sixtieth anniversary of the creation of Societe Generale. A look back at the establishment of the bank, made possible by three founders with complementary backgrounds and qualities.

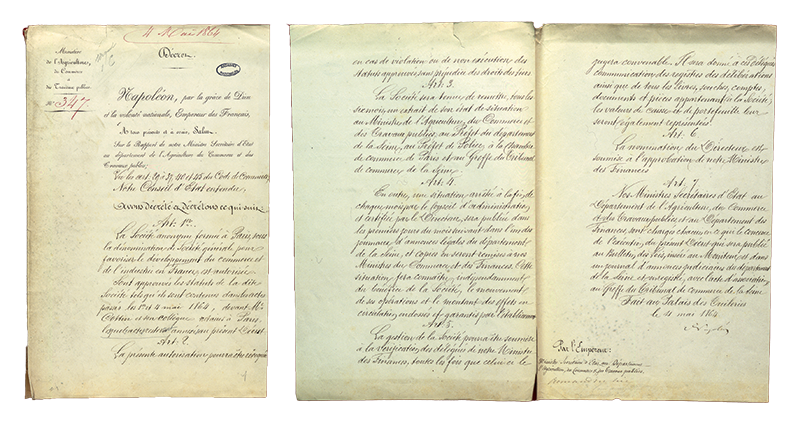

On 4 May, 1864, Napoleon III signed a decree establishing Societe Generale with the ambition of “fostering the development of commerce and industry in France”. This was all thanks to the vision and progressive ideals of a group of industrialists and financiers including the captain of industry Joseph-Eugène Schneider, the entrepreneur Paulin Talabot and the diplomat Edward Blount. Three entrepreneurs who combined their talents to found the bank and put it at the service of modernising the economy.

Joseph-Eugène Schneider, the visionary

Born in 1805, Joseph-Eugène Schneider began his professional life at the bank of Baron Seillière, specialising in the trading sector. With a strong personality, he developed a hard-working, entrepreneurial spirit and a vision that impressed his colleagues. In 1830, he took charge of the Bazeilles ironworks site bought by Baron Seillière. At the same time, he took courses at the National Conservatory of Arts and Crafts, from which he graduated with a distinction. This training made him aware of the crucial role of metallurgy and steel in the modernisation of the country.

In 1836, in the midst of the Industrial Revolution, he took over the Creusot forges, making it the largest factory in Europe. Nicknamed the “King of Iron”, he became a symbol of French industrial power, dominating the market for railway equipment and steamboats. Close to Napoleon III, he obtained the monarch’s signature on 4 May 1864, allowing Societe Generale to be created by decree. By collaborating with Paulin Talabot and Edward Blount, he would further anchor the young bank at the heart of the industrial world.

For 160 years, Societe Generale has been making its clients’ ideas grow

Shaped by generations of employees and customers, the Group has always supported economic development. Yesterday by accompanying the industrial revolution, today and tomorrow by resolutely addressing the challenges of our time for sustainable development and responsible transition. The strength of this legacy, inherited from previous generations, enables Societe Generale to face the future with audacity, determination and confidence.

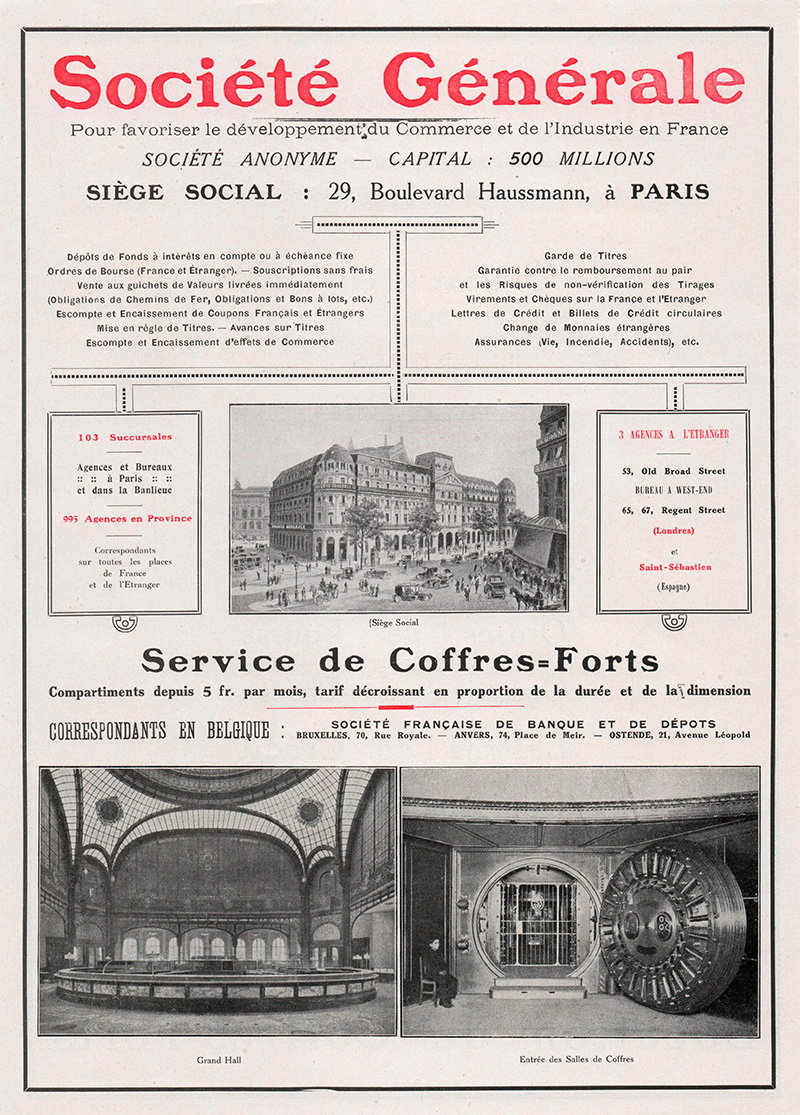

Advertisement for a rental service for safes, Central Agency, 1920s.

Decree establishing Societe Generale, signed by Napoleon III on 4 May 1864. (Societe Generale archives).

Paulin Talabot, the innovator

A young engineer, graduate of the Polytechnique and the School of Bridges and Roads, Paulin Talabot founded the Société des mines de la Grand-Combe et des chemins de fer du Gard in 1836, with his brother.

In 1852, he contributed to the creation of the largest railway company in France, the future “Paris-Lyon-Mediterranean” (PLM), which he would take charge of a decade later. In 1856, he founded the Marseille Docks and Warehouses Company. His reputation was such that he developed his activities abroad, notably presiding over the creation of rail networks in Italy and Austria. Drawing on his experience, Talabot quickly understood the benefit of collaboration between bankers and industrialists. Especially since from 1860, the signing of various free trade treaties favoured the boom in the capital markets. Provisionally director then administrator of Societe Generale (1865-1885), Talabot played a decisive role in bringing together finance and industry, making the bank a major player in the industrial and railway revolution.

Edward Blount, the diplomat

Born in England, Edward Blount began his career in his father’s bank in London, then at the Home Office of the British government. Attached to the embassy in Paris in 1829, then to the British consulate in Rome, he encouraged the development of railways including the networks of the north of France created by James de Rothschild and those in the South launched by Talabot.

The French Revolution of 1848 led to the failure of his bank, and in 1851 he established a limited partnership under the name Edward Blount & Co, which financed the railways and also became the bank of the papal government.

At the same time Blount was at the head of several industries. The Rhine Mines and Foundries Company in 1852, the General Water Company from 1861 to 1902 and the Western Railway Company from 1880 to 1894. In 1886, he joined Talabot within Societe Generale, where he was president until 1901. In the spring of 1871, he initiated the international expansion of the bank, by creating a branch in London, in the heart of the City, the nerve centre of international finance.

The synergy between the visions of these three founders was crucial to the rise of Societe Generale as one of the modern banks that would go on to shape the Twentieth Century.

© Societe Generale; Alamy images; Gallica

Bibliothèque Nationale de France