Sustainable finance for a sustainable future

Key stakes and concepts

Sustainable finance is a concept that incorporates environmental, social, and governance (ESG) criteria into investment decisions. The goal is to promote investments that contribute to sustainable economic development, environmental protection and social well-being.

Sustainable development: an inescapable part of our lives

Sustainability is a defining concept of our time. Popularised by the United Nations Brundtland Report in 1987, it is defined as “meeting the needs of the present without compromising the ability of future generations to meet their own needs”. Global awareness of the concept was elevated in 2015 when 193 UN member states signed 17 Sustainable Development Goals (SDGs), charting a path toward a better and more sustainable future for all by 2030.

A major indicator of this urgent need to act is Earth Overshoot Day: the date on which humanity has depleted all the resources the Earth can regenerate in a year. It is from this point that we begin to live on credit, using resources that belong to future generations. In 1970, Earth Overshoot Day was at the end of December. In 2024, it fell on 2 August. There are two primary factors behind this trend: the number of people on earth surged from 3.7 billion in 1970 to over 8 billion in 2024; and changes in our lifestyles have expanded our ecological footprint.

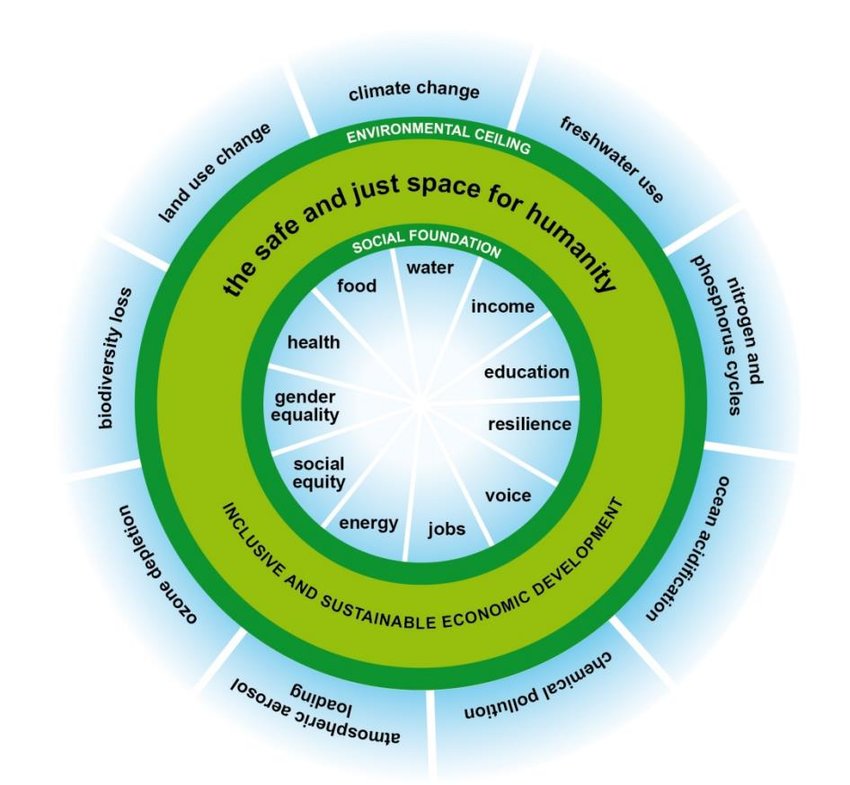

The sustainability challenge therefore is to strike a balance between our basic needs (healthcare, food, education, employment, income, etc.) and the respect of the environmental limits of our planet. The Doughnut Theory, developed by economist Kate Raworth, illustrates this quest to balance social well-being with the health of the planet.

The challenges of Sustainable Finance

Moving toward a sustainable lifestyle compatible with the Earth’s environmental limits requires us to think twice about how we consume, travel, live, and even eat. Beyond the psychological barriers, there is a significant economic cost. The climate transition alone is estimated to cost between €30 and €65 billion euros per year — an amount which public investments alone cannot cover.

This is where sustainable finance can help by bridging the gap between transition project leaders and the investors who can finance them. With household savings in France estimated at over €6 trillion, the potential to support this transition is huge.

Sustainable finance’s approach to meeting this financing challenge is threefold:

Green finance: Focusing on efforts to combat climate change and protect the environment, such as renewable energy, energy efficiency, the circular economy and environmentally-sustainable construction.

Socially Responsible Investment (SRI): An investment approach incorporating extra-financial criteria (environmental, social, and governance — ESG), as well as traditional financial criteria (profitability, dividends, rates, income, debt, etc.). SRI aims to channel investment flows to companies that are not only profitable but also contribute positively to the planet.

Solidarity finance: Backing projects with a strong social impact. Beneficiaries include foundations, cooperatives, non-profits and crowdfunding platforms.

Sustainable finance is therefore a strategic driver for addressing environmental and social challenges, while connecting investors with impactful projects. The investment opportunities it offers help balance financial profitability with a positive impact on society.

By Jean-Christophe Jouannais, Sustainable Finance Engineer

DISCLAIMER :

This document has no contractual value. It is not intended to provide an investment service such as investment advice, a related investment service, arbitration advice or legal, accounting or tax advice from Société Générale Private Banking France (‘SGPB France’), which cannot therefore be held liable for any decision taken by an investor solely on the basis of its content. SGPB France undertakes neither to update nor to modify it.

Before making any investment decision, please review the details of the documentation for the service or product being considered, including any associated risks, and consult your legal and tax advice. If the document is consulted by a French tax non-resident, he or she will have to ensure with his or her legal and tax advisors that he or she complies with the legal and regulatory provisions of the jurisdiction concerned. It is not intended for distribution in the United States, or to a U.S. tax resident, or to any person or jurisdiction for which such distribution would be restricted or unlawful.

The past performance information that may be reproduced is not intended to guarantee future performance. These future performances are therefore indicative. The return to investors will vary depending on market performance and the shelf life of the investment. Future performance may be subject to tax, which depends on your present and future personal situation.

Societe Generale has put in place a policy to manage conflicts of interest. SGPB France has put in place (i) a policy to handle complaints made by its customers, available on request from your private banker or on its website and (ii) a policy to protect personal data (https://www.privatebanking.societegenerale.com/fr/protection-donnees-personnelles/). At any time and without charge, you have the right to access, rectify, limit processing, erase your data and the right to object to their use for the purposes of commercial prospecting by contacting our Data Protection Officer by email (protectiondesdonnees@societegenerale.fr). In the event of a dispute, you can lodge a complaint with the Commission Nationale de l’Informatique et des Libertés (CNIL), the supervisory authority responsible for compliance with personal data obligations.

This document is issued by Societe Generale, a French bank authorized and supervised by the Prudential Control and Resolution Authority, located at 4 Place de Budapest, 75436 Paris Cedex 09, under the prudential supervision of the European Central Bank (‘ECB’) and registered with ORIAS as an insurance intermediary under number 07 022 493, orias.fr. Societe Generale is a French public limited company with a capital of EUR 1 003 724 927.50 on 17 November 2023, whose registered office is located at 29 boulevard Haussmann, 75009 Paris, and whose unique identification number is 552 120 222 R.C.S. Paris (ADEME FR231725_01YSGB). More details are available on request or at www.privatebanking.societegenerale.com/. This document may not be communicated or reproduced in whole or in part, without the prior written consent of SGPB France.