Expert Views : Art Banking

What is Art Banking? What is Société Générale Private Banking's approach in this field? Why consider art in your wealth management strategy?

What is Art Banking?

What is Société Générale Private Banking's approach in this field?

Why consider art in your wealth management strategy?

Art Banking: insights

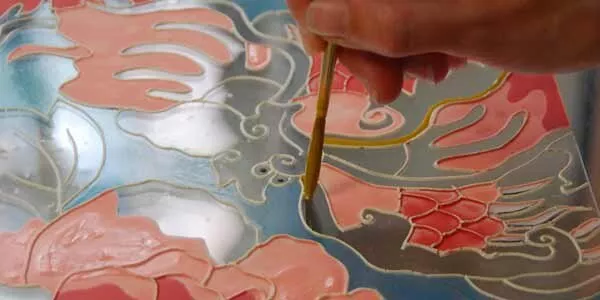

Art Banking or Art Advisory refers to a unique set of services orchestrated by Societe Generale Private Banking and delivered to a large extent by a series of art world experts that we have selected with great care. The subjects we cover are extremely diverse, going from the assistance in the authentication, the valuation, the acquisition, or the disposal of artworks or collectibles to putting together inventories, managing collections, helping our clients to reflect on the way they own or may want to transfer their assets to the next generation. Helping other clients to combine an interest in the art and a generous intention, let's call this, arts and philanthropy.

For which client profiles?

Our clients are extremely varied as well in terms of profiles. At one end of the spectrum, some of our clients may not be interested at all in the arts, but have inherited of works of art or collectibles that need to be sometimes authenticated, very often appraised in view of a potential disposal. Other clients are very seasoned collectors who need to be assisted in the way they structure a donation of a work of art, or even of an entire collection to their children or to their grandchildren. Other clients may want to be helped in the way they are thinking about putting together an artist residency program or an art prize. Some of our clients are also interested in getting invited at one of the great events we organized very regularly in the art world.

Collectibles: an asset class in its own right

We do not present the acquisition of works of art or collectibles as a financial investment our clients should expect a capital gain from. We really believe that the “raison d'être”, the reason why a work of art is created in the first instance is to generate pleasure, esthetic pleasure, intellectual pleasure, to participate as well in the pleasure of the collector, to be surrounded by beautiful objects. All this you cannot measure in euros, sterling or dollars. But at the same time, financial stakes can be quite significant and it is, in our opinion, absolutely essential that our clients are well assisted when it comes to dealing with this very special class of assets that are collectibles and works of art.

If you would like to know more about our services, please do engage in a conversation with your private banker and we will be delighted to help you dealing with your works of art and collectibles.

Would you like to discuss this subject further with us?

GENERAL DISCLAIMER:

Societe Generale Private Banking is Societe Generale Group’s business operating through its head office at Societe Generale SA, as well as departments, branches and subsidiaries located in the areas referred to below, under the Societe Generale Private Banking brand, and is the distributor of this document.

The information shared on this page is for information purposes only and may be amended without prior notice. Its content is not intended to provide an investment service. In addition, it does not constitute investment advice or a personalised recommendation on a financial product, or advice or a personalised recommendation on insurance, or any form of canvassing, or legal, tax or accounting advice from any Societe Generale Private Banking entity whatsoever.

The offers related to the businesses and to the wealth management and financial information referred to on this page depend on each client’s personal situation, the legislation that applies to them, and their tax residence.

Therefore, these offers may not be suitable or authorised in all Societe Generale Private Banking entities. Furthermore, access to some of these offers is subject to specific eligibility conditions. Certain offers mentioned may incur various risks, involve potential loss of the entire amount invested, or even unlimited potential loss, and consequently may be restricted to a certain category of investor, and/or be suitable only for experienced investors who are eligible for these types of products, services and offers.

Contact private banker to find out whether these offers are suited to your needs and adapted to your investor profile.

DISCLAIMERS BY JURISDICTION

France: Unless indicated otherwise, this document is published and distributed by Societe Generale, a French bank authorised and supervised by the Autorité de Contrôle Prudentiel et de Résolution (French Prudential Supervisory and Resolution Authority), located at 4 place de Budapest, CS 92459, 75436 Paris Cedex 09, under the prudential supervision of the European Central Bank (ECB) and registered with ORIAS as an insurance broker under number 07 022 493, orias.fr. Societe Generale is a public limited company (société anonyme) under French law, with capital stock of €1, 003, 724, 927.50 as of 17 November 2023 with its registered office at 29 boulevard Haussmann, 75009 Paris, France, and registered with the Paris Trade and Companies Register (Paris R.C.S) under the unique identification number 552 120 222. Paris. More details are available on request or online at www.privatebanking.societegenerale.com/.

Luxembourg: This document is distributed in Luxembourg by Societe Generale Bank Luxembourg, a limited public company (société anonyme) under Luxembourg law, registered at Luxembourg’s companies house under the number B 6061 and registered credit institution regulated by the Financial Sector’s Surveillance Commission (CSSF) under the control of the European Central Bank (ECB), and whose registered office is located at 11 avenue Emile Reuter – L 2420 Luxembourg. More details are available on request or online at www.privatebanking.societegenerale.lu/. No investment decision should be made solely on the basis of this document. Societe Generale Luxembourg accepts no responsibility for the accuracy or otherwise of information contained in this document. Societe Generale Luxembourg accepts no liability or otherwise in respect of actions taken by recipients on the basis of this document only, and Societe Generale Luxembourg does not hold itself out as providing any advice, particularly in relation to investment services. The opinions, views and forecasts expressed in this document (including any attachments thereto) reflect the personal views of the author(s) and do not reflect the views of any other person or Societe Generale Luxembourg unless otherwise mentioned. This document was prepared by Societe Generale. The CSSF has neither verified nor analysed the information contained in this document.

Monaco: This document is distributed in Monaco by Societe Generale Private Banking (Monaco), a joint stock company (SAM) under Monaco law registered at 11 avenue de Grande Bretagne, 98000 Monaco, Principality of Monaco, governed by the French Prudential Supervisory and Resolution Authority (ACPR) and the Financial Activities Supervisory Commission (CCAF) of Monaco. Financial products sold in Monaco may be restricted to qualified investors under Act no. 1339 of 07/09/2007 and Sovereign Order no. 1285 of 10/09/2007. More details are available on request or online at www.privatebanking.societegenerale.com/.

Switzerland: This document may constitute advertising within the meaning of the Swiss Federal Act on Financial Services (LSFin). It is distributed in Switzerland by Societe Generale Private Banking (Switzerland) SA (SGPBS or the Bank), whose registered office is located at rue du Rhône 8, CH-1204 Geneva. SGPBS is a bank authorised by the Swiss Financial Market Supervisory Authority (FINMA). This document may under no circumstances be considered as investment advice or recommendations from SGPBS. The Bank recommends obtaining the advice of a professional before acting or not acting on the basis of this document, and accepts no responsibility in relation to the content of this document. Financial instruments, including shares in collective investment funds and financial products, may only be offered in compliance with LSFin. More information is available from SGPBS on request or online at www.privatebanking.societegenerale.com.

This document is distributed neither by SG Kleinwort Hambros Bank Limited in the United Kingdom, nor by its branches in Jersey, Guernsey and Gibraltar which operate collectively under the “SG Kleinwort Hambros” brand. Accordingly, the information provided and any offers, wealth management and financial businesses and information do not concern these entities and may not be authorised by these entities nor adapted to these regions. More information on the activities of Societe Generale Private Banking entities located in the United Kingdom, the Channel Islands and Gibraltar, including supplementary legal and regulatory information, is available at www.kleinworthambros.com.