Blockchain: A technology based on the decentralisation of data

Blockchain is a technology very often associated with Bitcoin, which began in 2009. Countless other blockchains have developed since then. But how does this new technology that manages transactions1 on the internet and shares data between what are not necessarily trusted intermediaries actually work?

François-Henri Paroissin

Chief Digital Officer chez Societe Generale Private Banking France

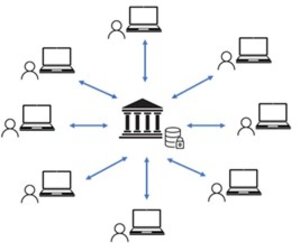

Traditional networks are centralised, meaning they need the intervention of a trusted third party to collect transaction requests, perform due diligence on those making the requests, approve the requests, and execute them as appropriate. These systems have just one ledger and one overseeing authority.

A bank for instance is responsible for keeping a record of what customers own and their transaction history. As the trusted third party, the bank records all this information in a centralised ledger.

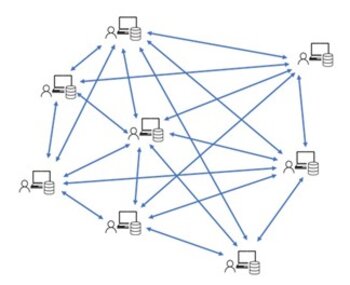

Blockchain is an alternative technology for storing and transferring information. It provides a decentralised means of sharing a secure, unalterable database, bypassing the need for a trusted third party, via a network of “nodes”. The more nodes there are, the bigger and, all things being equal, the more secure the blockchain.

Nodes are the individual computers running the blockchain software, similar to a protocol: a set of rules that enable all these computers to communicate and interact with each other. This is known as a peer-to-peer network. As we’ll discover, different kinds of nodes exist.

While a blockchain also has a single ledger, it is widely replicated (nodes), public (anyone can consult the transactions) and inalterable (the transactions are irrefutable). The confidentiality of transactions is protected by way of pseudonymity.

The nodes share every update — i.e. the history of all the transactions carried out on the network —with the ledger.

There are also two cryptographic tools needed to run a blockchain effectively: asymmetric encryption (enabling transactions to be signed and their validity verified) and hashing. We’ll come back to these concepts in more detail.

A blockchain is made up of several kinds of nodes, and these three in particular:

Full nodes maintain a complete copy of the blockchain ledger (entire history since the start of the transactions) and run the protocol. They broadcast transactions to other nodes. Invalid transactions are rejected, while valid transactions enter a “mempool” with other transactions waiting to be added to the blockchain by a miner or validator node.

Light nodes do not store all the transactions made on the blockchain, but only the block headers. This allows them to verify transactions, but not secure the network like full nodes. They are especially used by crypto-asset software wallets.

Miner or validator nodes (miners and validators) generate blocks of valid transactions held in the mempool2, and add them to the blockchain to allow transactions to be properly processed (see below).

What are behind the words “block” and “chain”?

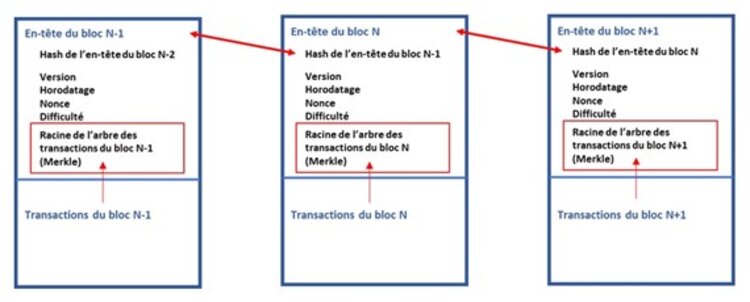

A blockchain is a sequence of transaction blocks added one after the other in chronological order. They are referred to as a chain because they are linked together using a fundamental cryptographic function called hashing that secures the blockchain.

This hashing function takes any data of any size as input and generates a hash as output, i.e. a string — or chain — of characters of fixed length. It’s essentially a kind of digital signature of the input data.

The slightest change to any of the input data will generate a completely different hash, making any alteration to all or part of the source data very easy to detect.

In a blockchain, each header of a block of transactions (= the input) is hashed, and the corresponding hash is added to the next block. So any tampering of even the smallest transaction in a previous block would result in a completely different hash for the entire block, and this would be detected instantly. This would have an impact on the entire transaction history: any change would be picked up when the ledger is updated, which would create a discrepancy between hashes, and therefore be rejected by the nodes.

This thwarts any attempts by hackers to double spend3. And since it is a decentralised system, the perpetrator would have to modify most copies of the registry, which in practice is impossible given the sheer volume of nodes.

Example:

The hash of the header of the previous block is

9fc07c2c159594398feb31779dcc184c1ffe9868e29e42f452c98778074cf811

If any change whatsoever is made to a transaction in that block, the hash of the header would become:

afaa62b51605a9662346d449cf0aa6ca41eb47662435ebb510e75de3b907a797

This hash is entirely different from the one initially calculated, and the alteration would be propagated to subsequent blocks.

The transaction history is identical on all the computers in the network.

As soon as a new block is added, the full nodes synchronise to maintain the same transaction status.

Given the lack of a central authority, how can we be sure that transactions are valid?

The validity of transactions is based on asymmetric cryptography, which generates keypairs made up of public keys (which can be shared) and private keys (which are secret). Each public key is derived from a private key, which is used to access and transfer tokens by signing the transaction. With the public key, the nodes can verify the validity of a transaction signed with the private key.

For a blockchain to work, a consensus needs to be established among all the parties involved in the network (i.e. the nodes described above). There are several consensus algorithms. The best known are Proof-of-Work (PoW) and Proof-of-Stake (PoS)4.

The nodes responsible for adding new blocks of valid transactions to the blockchain are the miners (PoW blockchain) and validators (PoS blockchain):

In PoW blockchains, each miner tries to be the first to solve a cryptographic problem defined by the protocol. Solving this problem requires a great many iterations (and therefore a very high energy cost for processing). When a miner has found the solution, they announces it to the other miners, who can easily verify it. The miner can then add their block of transactions to the blockchain, in exchange for new tokens and transaction fees. A block is added at regular intervals, depending on the blockchain. The blockchain grows and the ledger is updated by all the nodes. It is a distributed consensus based on mathematics that makes it possible to know who owns what at any given moment. Given how much processing power is needed, and therefore the corresponding economic cost, miners are incentivised to comply with the validation rules if they want to collect the new tokens issued and the transaction fees.

PoS blockchains have a different consensus. Validators stake a certain number of tokens. As a rule, the more tokens they hold, the more likely they are to be selected to validate transactions and form the block that will be attached to the blockchain. Broadly speaking, there is also an economic incentive to make up the blocks correctly, otherwise the validator loses the immobilised tokens, resulting in a substantial financial loss. By complying with the validation protocol, the validator receives new tokens and transaction fees. Such reward mechanisms may vary from one blockchain to another and depend on the protocol, which may evolve over time.

Public, private or consortium blockchains

The very premise of a blockchain is that it is open to anyone who wants to participate. Here we talk about as public, open or “permissionless” blockchains. As we have seen, they operate using consensus algorithms, the most well known of these being Bitcoin and Ethereum. Anyone can install the protocol's open source code to become a node on the network. Anyone can use a blockchain to carry out transactions, using a public-private keypair. And because it is by nature a public distributed ledger, anyone can view the transactions on the blockchain. All you need to do is consult a blockchain explorer like Bitcoin’s Bitcoin Explorer, Etherscan for Ethereum, and Explorer Solana for Solana).

A public blockchain is therefore entirely transparent.

In addition to public blockchains, there are:

Consortium blockchains, where the consensus process is checked by a pre-selected set of nodes or by a pre-selected number of stakeholders (e.g. Ripple )

Private blockchains, which can only be accessed by authorised users and in accordance with rules imposed by the company that controls the network. Here we have the notion of a central authority, which makes it difficult to consider such a network as a blockchain.

Public blockchains are the backbone of web3, the Internet of Value5: Bitcoin, which could be a long-term value reserve, Ethereum and level 2 blockchains, which create opportunities to commit different parties via smart contracts, and offer stable coins — the very foundation of decentralised finance . These are all opportunities to develop new economic and financial ecosystems.

3 See Deciphering Bitcoin: unlocking the concept.

4 Some blockchains have changed their consensus: Ethereum has shifted from PoW to PoS.

5 We will expand on these topics in our next articles.

GENERAL DISCLAIMER:

Societe Generale Private Banking is Societe Generale Group’s business operating through its head office at Societe Generale SA, as well as departments, branches and subsidiaries located in the areas referred to below, under the Societe Generale Private Banking brand, and is the distributor of this document.

This is an advertising document and holds no contractual value. It is not intended to provide an investment service. In addition, it does not constitute investment advice or a personalised recommendation on a financial product, or advice or a personalised recommendation on insurance, or any form of canvassing, or legal, tax or accounting advice from any Societe Generale Private Banking entity whatsoever.

The information contained in this document may be amended without prior notice, and is for illustrative purposes only to provide the reader with information that may be of use in making decisions. Any information on past performance, even repeated performance, does not under any circumstances guarantee future performance.

The private bankers of the Societe Generale Private Banking entities can provide potential investors with more detailed information on the offerings, within their Societe Generale Private Banking entity, in the theme presented in this document.

This document is confidential and intended solely for the recipient. It may not be made public or disclosed to any third party, nor reproduced in whole or in part without the prior and written agreement of the Societe Generale Private Banking entity concerned.

Under no circumstances shall any Societe Generale Private Banking entity be held liable for any decision made by an investor on the basis of this information alone.

Societe Generale Group maintains an operational administrative organisation taking all necessary measures to identify, verify and manage conflicts of interest. To that end, the entities of Societe Generale Private Banking have established a conflicts of interest management policy aimed at managing and preventing conflicts of interest. For more details, clients of Societe Generale Private Banking may refer to the conflicts of interest management policy available on request from their private banker.

Societe Generale Private Banking have also established a policy to address any complaints filed by its clients. Clients may request this policy from their private banker or on the institutional website of Societe Generale Private Banking (www.privatebanking.societegenerale.com).

DISCLAIMERS BY JURISDICTION

France: Unless indicated otherwise, this document is published and distributed by Societe Generale, a French bank authorised and supervised by the Autorité de Contrôle Prudentiel et de Résolution (French Prudential Supervisory and Resolution Authority), located at 4 place de Budapest, CS 92459, 75436 Paris Cedex 09, under the prudential supervision of the European Central Bank (ECB) and registered with ORIAS as an insurance broker under number 07 022 493, orias.fr. Societe Generale is a public limited company (société anonyme) under French law, with capital stock of €1, 003, 724, 927.50 as of 17 November 2023 with its registered office at 29 boulevard Haussmann, 75009 Paris, France, and registered with the Paris Trade and Companies Register (Paris R.C.S) under the unique identification number 552 120 222. Paris. More details are available on request or online at www.privatebanking.societegenerale.com/.

Luxembourg: This document is distributed in Luxembourg by Societe Generale Bank Luxembourg, a limited public company (société anonyme) under Luxembourg law, registered at Luxembourg’s companies house under the number B 6061 and registered credit institution regulated by the Financial Sector’s Surveillance Commission (CSSF) under the control of the European Central Bank (ECB), and whose registered office is located at 11 avenue Emile Reuter – L 2420 Luxembourg. More details are available on request or online at www.privatebanking.societegenerale.lu/. No investment decision should be made solely on the basis of this document. Societe Generale Luxembourg accepts no responsibility for the accuracy or otherwise of information contained in this document. Societe Generale Luxembourg accepts no liability or otherwise in respect of actions taken by recipients on the basis of this document only, and Societe Generale Luxembourg does not hold itself out as providing any advice, particularly in relation to investment services. The opinions, views and forecasts expressed in this document (including any attachments thereto) reflect the personal views of the author(s) and do not reflect the views of any other person or Societe Generale Luxembourg unless otherwise mentioned. This document was prepared by Societe Generale. The CSSF has neither verified nor analysed the information contained in this document.

Monaco: This document is distributed in Monaco by Societe Generale Private Banking (Monaco), a joint stock company (SAM) under Monaco law registered at 11 avenue de Grande Bretagne, 98000 Monaco, Principality of Monaco, governed by the French Prudential Supervisory and Resolution Authority (ACPR) and the Financial Activities Supervisory Commission (CCAF) of Monaco. Financial products sold in Monaco may be restricted to qualified investors under Act no. 1339 of 07/09/2007 and Sovereign Order no. 1285 of 10/09/2007. More details are available on request or online at www.privatebanking.societegenerale.com/.

Switzerland: This document may constitute advertising within the meaning of the Swiss Federal Act on Financial Services (LSFin). It is distributed in Switzerland by Societe Generale Private Banking (Switzerland) SA (SGPBS or the Bank), whose registered office is located at rue du Rhône 8, CH-1204 Geneva. SGPBS is a bank authorised by the Swiss Financial Market Supervisory Authority (FINMA). This document may under no circumstances be considered as investment advice or recommendations from SGPBS. The Bank recommends obtaining the advice of an expert before acting or not acting on the basis of this document, and accepts no responsibility in relation to the content of this document. Financial instruments, including shares in collective investment funds and financial products, may only be offered in compliance with LSFin. More information is available from SGPBS on request or online at www.privatebanking.societegenerale.com.

This document is distributed neither by SG Kleinwort Hambros Bank Limited in the United Kingdom, nor by its branches in Jersey, Guernsey and Gibraltar which operate collectively under the “Kleinwort Hambros” brand. Accordingly, the information provided and any offers, wealth management and financial businesses and information do not concern these entities and may not be authorised by these entities nor adapted to these regions. More information on the activities of Societe Generale Private Banking entities located in the United Kingdom, the Channel Islands and Gibraltar, including supplementary legal and regulatory information, is available at www.kleinworthambros.com.