A handpicked selection of top-tier experts

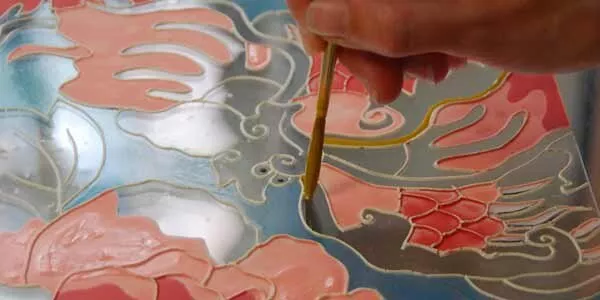

Art Banking

Are you planning to buy, sell or transfer artwork or other valuables (e.g. watches, jewellery or collector cars)? Or perhaps you want to build, manage and protect a collection? Whatever the case, professional advice is essential to help you make an informed decision.

What is Art Wealth Management?

Here at Societe Generale Private Banking, Art Banking – or Art Wealth Management – refers to a unique set of services coordinated by us and delivered largely by professionals from the art world. Just like with Wine Banking, these services are vast in scope, ranging from appraising, authenticating, buying and selling artworks and valuables, to advice on collecting, inventory management, forms of ownership, succession, insurance and even the fascinating subject of philanthropy in the arts.

Understand your needs

Societe Generale Private Banking offers a range of services delivered by art market professionals:

Acquisitions and sales. Are you looking to buy, sell or transfer artwork and/or collectibles? Our partners will guide you every step of the way, from the initial valuation to the final transaction.

Building a portfolio. Are you hoping to start a collection? Our partners will help you define and implement a plan that reflects your needs, goals and personal taste.

Collection management. Do you want to protect your assets, assess their current value or transfer your art to others? From inventory and insurance to valuation and collection management, our partners offer solutions to safeguard your assets and help you implement your art wealth decisions.

Art and philanthropy. Are you a philanthropist keen to combine your passion for the arts with your personal convictions? Together, our teams and specialist partners provide the information you need to put your plans into action.

Why us ?

An international service attuned to a global market

Long-term support coordinated by Societe Generale Private Banking

Step by step

#1

You identify a need or interest relating to the arts and/or collectibles.

#2

You engage in 360-degree discussions with our Art Banker.

#3

We select and introduce you to the most suitable professionals for your needs.

#4

We launch and monitor the consultancy service.

#5

We assess the next step: sometimes a new need is identified during the consultancy process (e.g. an inventory can lead to the sale or transfer of an artwork, or a request for insurance).

Questions/Answers

No, quite the opposite. Our services are designed for a wide variety of clients: some want help making their first purchase or starting a collection; others want a pre-sale valuation, insurance, advice on transferring a collection, or even help engaging in art-related philanthropy.

Our Head of Art Banking Services is both a banker and an art historian. However, our aim is not to become an “expert” in art. We have chosen to partner with external professionals from the art world, whose invaluable experience, knowledge and infrastructure would be difficult to replicate in a bank. Handpicking experts in this way allows us to provide bespoke services tailored to our clients’ exact needs.

Art valuation takes into account the intrinsic properties of an object (artist name and reputation, medium, dimensions, provenance, condition, publications, exhibitions, etc.) and market factors (similar transactions, global economic context, alignment to current tastes, novelty or “freshness” to the market, etc.). Since most artworks are unique and appraisals somewhat subjective, putting a financial value on an artwork is not an exact science. This is particularly true when an artist does not have much of a secondary (auction) market.

Authentication is a process that seeks to establish a consensus of evidence by combining technical, historical and artistic analysis of the object with an examination of the available documentation (invoices, certificates) and research on provenance (history of ownership). Before buying any art it is essential you check that due diligence has been performed by reputable professionals to confirm the object’s authenticity and legal status (proof of ownership, import/export conditions, absence of legal disputes linked to stolen or misappropriated art, etc.).

Although art and collectibles are an asset class in their own right, making it sensible to seek professional advice, we do not present art as a speculative investment from which you should expect a capital gain. In other words, while the investment potential of such assets must be taken into account, there is no denying that the main purpose of an artwork or beautiful object is to spark joy. This pleasure – the true “payoff” of art – is intangible and cannot be measured in money.

When it comes to advising on a purchase, our service typically begins by defining an objective (type of artwork, artists, media, etc. sought), after which we create a portfolio of available works, conduct due diligence, analyse the price, potentially negotiate, agree on the artwork and purchase price, and then close and complete the sale (including help with paperwork and documentation, logistics and/or insurance). In some cases, we also provide assistance with framing and hanging (often fundamental for conservation).

The first, crucial step is to set an ambitious yet realistic target price, which in some cases means confirming authenticity in advance. The second step is strategic and involves deciding on the best sales channel to obtain the desired price (e.g. public auction vs private sale; national vs international market, etc.). The third step is to initiate the sales process, from negotiating the terms and choosing partners to completing the transaction.