"The Art of Collecting" podcast - Episode #7 The art of transfers and donations

Full Script:

Laurent Issaurat: Hello, my name is Laurent Issaurat, Head of Art Banking at Societe Generale Private Banking, and I am pleased to welcome you to our podcast series “The Art of Collecting Art”. Each episode, we will explore issues involved in owning and managing artworks and collectors’ items. Today brings us to the end of our series. In this seventh and final episode, I am joined by Marceau Clermon, Notary-in-Partnership at the Fidnot notary office, who will share with us his expert insight on the transfer and donation of an artwork or a collectors’ item. Hello Marceau.

Marceau Clermon: Hello Laurent.

Laurent Issaurat: Are artworks and collectors’ items just another kind of furniture?

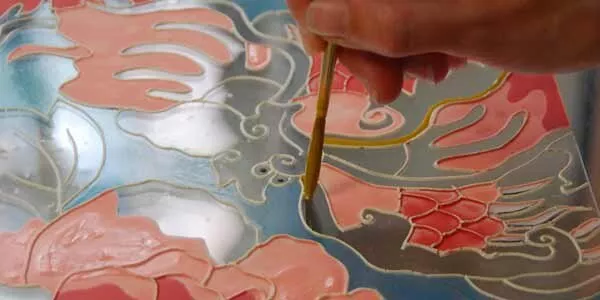

Marceau Clermon: It may seem counter-intuitive, but they are not always seen as moveable items. Some works may form part of a building — sculptures set into the building or certain mosaics, for instance. The mosaics by INVADER(1) found on walls in numerous capitals also come to mind. You then have what is called “furnishing furniture”, those that are built into homes, as defined in the French Civil Code. This is where the categories overlap. Not all artworks are “furnishing furniture”; and not all items of moveable property are artworks. Article 534 of the French Civil Code excludes the following from “furnishing furniture”, and I quote: “collections of paintings which may be in galleries, or private pieces.” Barring this reserve, and irrespective of their value, artworks can legally fall under the “furnishing furniture” category.

Laurent Issaurat: In terms of documentation, because artworks are very often considered as an item of furniture, there is often no record of their ownership, not even invoices, for instance. What would be your advice?

Marceau Clermon: Indeed, many owners of artworks or pieces think that possession alone gives legal title and the protection that goes with it. Other than demonstrating physical ownership of the object, it is essential to keep a record of all evidence of its acquisition, such as a sales receipt, proof of payment, bill of entry, copies of correspondence the seller, etc. While all this seems good common sense, the reality is far more complex... especially if the object became came into the holder’s possession as part of a transfer. While they may have the key documents that attests to an item’s authenticity and are used for valuation purposes, often there is no proof of ownership. Statements of inheritance, donation, or sharing of ownership do not constitute legal title, even though such documentation can serve as prima facie evidence or presumption of lawful possession. Some beneficiaries may claim ownership of artworks by taking action to establish title, which is made easier when the holder is without documented evidence. My advice would be to obtain statements of ownership from all parties, official reports from the bailiff, or declare these statements in registered deeds.

Laurent Issaurat: How does one transfer art assets to one’s children or grandchildren? Is it possible to legally divide the ownership of an artwork by differentiating between bare ownership and right of use?

Marceau Clermon: To transfer artworks or objects to future generations, it is possible to donate full or bare ownership(2). Full ownership gives descendants the right to own, use, and earn income from an asset. Such donations ensure an indisputable title of ownership. Accordingly, if the piece is sold at a later stage, it will meet the conditions for a capital gains tax exemption for the duration of the holding period. Known as giving inter vivos (“donation-partage” in France), the donor can, in their lifetime, share their wealth among the heirs of their choice. Today, in early 2022, donors can use inter vivos gifts to divide their estate down the generations for the purpose of reincorporation (donation-partage trans-générationnelle-réincorporative). Under this scheme, the artworks or items “roll” from the donor’s children, to their children’s children, depending on the initial donor’s preference. The registered donation must have been registered for over 15 years, and the tax cost is thereby reduced to partition duties of 2.5%. All these arrangements apply as per the usual legal and fiscal conditions.

Laurent Issaurat: There is also the case of gifts in the traditional sense, be it for events such as weddings, births, or birthdays. Gifts from hand to hand — a donation handed over by the donor in their lifetime — also come to mind. What are the advantages of an inter vivos gift as opposed to other forms of transfers which seem more straightforward?

Marceau Clermon: From a legal and fiscal standpoint, traditional gifts have the disadvantage of being difficult to trace. If there is an objection, no proof means no rights! It's the cause of many family disputes, for possession alone does not constitute ownership. Gifts from hand to hand are generally recognised for tax purposes. However, this in itself is not proof of the donation having taken place, as the declaration is made only by the beneficiary of the gift. We therefore recommend obtaining documents from the donor that the gift is not a loan but a donation, for this too is cause for dispute. Notarial deeds are all the more important when donating artworks or collectibles, for they express the intent to donate, while providing an accurate description of the object. Inter vivos gifts also offer the security of avoiding economic rebalancing upon the death of the donor where there are more than one heirs. Given how volatile the value of art can be, this is a very sound precaution.

Laurent Issaurat: Is transferring artworks to a company another option?

Marceau Clermon: Yes. Placing works of art in a company opens up new possibilities with respect to holding or transferring art. In the past this was a fiscal barrier, as privately-held works of art were exempted from wealth tax while company shares holding art were not. Entrusting artworks to a company is also a way for living artists to organise their estate, and even benefit from the advantages of the Dutreil scheme(3) for transferring businesses.

Laurent Issaurat: How are art assets valued during a succession?

Marceau Clermon: The market value of the assets must apply and can be determined by a number of ways. It can be based on the prices observed at an auction sale within two years of death. It can also be based on the estimates of an auctioneer as part of a notarised inventory, or on the individual value of objects established in insurance policies. Should the artworks or pieces be considered “furnishing furniture”, the flat rate for moveable objects can be used. In this respect, the value of the moveable asset counts for 5% of the total value of the real estate or moveable assets. That said, the French tax code allows the submission of contrary evidence to tax authorities: from a legal standpoint, if it can be proven that a masterpiece painting is part of the furniture and furnishings of a home and that, from a tax perspective, the moveable assets are worth more than 5% of the total value of the estate, the flat tax can be ruled out.

Laurent Issaurat: Thank you Marceau for your clear and precise explanations on what is a technical topic. This brings us to the end of the “Art of Collecting Art”. It was a pleasure to explore with you the broad strokes of owning and managing artworks and collectors’ items, with the help of our expert guests. You’ll find all our episodes on Apple Podcasts and Spotify via our programme “#PrivateTalk by Société Générale Private Banking”. Thank you for tuning in, and until next time for new podcasts from Societe Generale Private Banking!

(1) The French street artist INVADER created a series of mosaic tile “Space Invaders” in cities all around the world.

(2) The right of an owner to dispose of property, without being able to use it, without having the enjoyment conferred on a usufructuary, or to derive rental income from it. The bare owner can sell his right of ownership, without selling the enjoyment of the property. Source : https://www.service-public.fr/particuliers/vosdroits/F33076

Would you like to discuss this subject further with us?

The information contained in this audio content is provided for informational purposes only, is subject to change without notice, and is intended to provide information that may be useful in making a decision. Past performance information may be reproduced and is not a guarantee of future performance.

The price and value of investments and the income derived from them may fluctuate, both up and down. Changes in inflation, interest rates and exchange rates may adversely affect the value, price and income of investments denominated in a currency other than that of the investor. Any simulations and examples contained in this publication are provided for illustrative purposes only. This information is subject to change as a result of market fluctuations, and the information and opinions contained in this publication may change. No Societe Generale Private Banking entity undertakes to update or amend this publication, which may become obsolete after being reviewed, and will not assume any responsibility in this regard.

The offers related to the activities and financial and asset information mentioned in this audio content depend on the personal situation of each client, the legislation applicable to him and his tax residence. It is the responsibility of the potential investor to ensure with his legal and tax advisors that he complies with the legal and regulatory provisions of the jurisdiction concerned. This audio content is not intended to be played in the United States, by any U.S. tax resident, or by any person or in any jurisdiction where such playing would be restricted or illegal.

The offers related to the activities and financial and wealth information presented may not be adapted or authorized within all Société Générale Private Banking entities. In addition, access to some of these offers is subject to conditions of eligibility.

Certain offers related to the above-mentioned activities and financial information may present various risks, imply a potential loss of the entire amount invested or even an unlimited potential loss, and therefore be reserved only for a certain category of investors, and/or be suitable only for informed investors who are eligible for these types of offers.

Prior to any subscription to an investment service, a financial product or an insurance product, depending on the case and the applicable legislation, the potential investor will be questioned by his private banker within the Societe Generale Private Banking entity of which he is a client on his knowledge, his experience in investment matters, as well as on his financial situation including his capacity to bear losses, and his investment objectives, including his risk tolerance, in order to determine with him whether he is eligible to subscribe to the financial product(s) and/or investment service(s) envisaged and whether the product(s) or investment service(s) is/are compatible with his investment profile.

The potential investor must also (i) take note of all the information contained in the detailed documentation of the service or product envisaged (document entitled "key information for the investor", prospectus, regulations, articles of association, document entitled "key information for the investor", term sheet, information notice, contractual terms and conditions, etc.), in particular those relating to the associated risks; and (ii) consult its legal and tax advisors to assess the legal consequences and tax treatment of the product or service envisaged. It is reminded that the subscription to an investment service, a financial product or an insurance product may have tax consequences and Société Générale Private Banking does not provide tax advice. His private banker will also be available to provide further information, to determine with him whether he is eligible for the product or service under consideration, which may be subject to conditions, and whether it meets his needs.

Accordingly, no entity under the control of Société Générale Private Banking can be held liable for any decision made by an investor based solely on the information contained in this audio content.

This audio content is confidential, intended exclusively for the person consulting it, and may not be communicated or made known to third parties, nor reproduced in whole or in part, without the prior written consent of the Société Générale Private Banking entity concerned.

Societe Generale Group maintains an effective administrative organization that takes all necessary measures to identify, control and manage conflicts of interest. To this end, Societe Generale Private Banking entities have put in place a conflict of interest management policy to manage and prevent conflicts of interest. For more details, Société Générale Private Banking clients can refer to the Conflict of Interest Policy available on request from their private banker.

Societe Generale Private Banking has also put in place a policy for handling complaints from its clients, which is available on request from their private banker or on the Societe Generale Private Banking website.

SPECIFIC WARNINGS BY JURISDICTION

France: Unless expressly stated otherwise, this document is published and distributed by Société Générale, a French bank authorized and supervised by the Autorité de Contrôle Prudentiel et de Résolution, located at 4, place de Budapest, CS 92459, 75436 Paris Cedex 09, under the prudential supervision of the European Central Bank ("ECB") and registered with the ORIAS as an insurance intermediary under the number 07 022 493 orias.fr Societe Generale is a French société anonyme with a capital of EUR 1 066 714 367,50 as of August 1, 2019, whose registered office is located at 29, boulevard Haussmann, 75009 Paris, and whose unique identification number is 552 120 222 R.C.S. Paris. Further details are available on request or at www.privatebanking.societegenerale.com.

Luxembourg: This document is distributed in Luxembourg by Société Générale Luxembourg, a public limited company registered with the Luxembourg Trade and Companies Register under number B 6061 and a credit institution authorized and regulated by the Commission de Surveillance du Secteur Financier ("CSSF"), under the prudential supervision of the European Central Bank ("ECB"), and whose registered office is located at 11, avenue Emile Reuter - L 2420 Luxembourg Further details are available on request or at www.societegenerale.lu. No investment decision of any kind should be made on the basis of this document alone. Société Générale Luxembourg accepts no responsibility for the accuracy or otherwise of the information contained in this document. Societe Generale Luxembourg accepts no responsibility for any actions taken by the recipient of this document solely on the basis of this document, and Societe Generale Luxembourg does not represent itself as providing any advice, in particular with respect to investment services. The opinions, views and forecasts expressed in this document (including its annexes) reflect the personal opinions of the author(s) and do not reflect the opinions of any other person or of Société Générale Luxembourg, unless otherwise indicated. This document has been prepared by Societe Generale. The CSSF has not carried out any analysis, verification or control on the content of this document.

Monaco: This document is distributed in Monaco by Société Générale Private Banking (Monaco) S.A.M., located at 11 avenue de Grande Bretagne, 98000 Monaco, Principality of Monaco, regulated by the Autorité de Contrôle Prudentiel et de Résolution and the Commission de Contrôle des Activités Financières. Financial products marketed in Monaco may be reserved for qualified investors in accordance with the provisions of Law n° 1.339 of 07/09/2007 and Sovereign Order n° 1. 285 of 10/09/2007. Further details are available on request or at www.privatebanking.societegenerale.com.

Switzerland: This document is distributed in Switzerland by SOCIETE GENERALE Private Banking (Suisse) SA ("SGPBS"), headquartered at rue du Rhône 8, CH-1204 Geneva, Switzerland. SGPBS is a bank authorized by the Swiss Financial Market Supervisory Authority ("FINMA"). Collective investments and structured products may only be offered in accordance with the Swiss Federal Act on Collective Investment Schemes (Collective Investment Schemes Act, CISA) of June 23, 2006, and the Guidelines of the Swiss Bankers Association (SBA) on Information for Investors in Structured Products. Further details are available on request from SGPBS or at www.privatebanking.societegenerale.com.

This document is not distributed by the entities of the Kleinwort Hambros Group that operate under the brand name "Kleinwort Hambros" in the United Kingdom (SG Kleinwort Hambros Bank Limited), Jersey and Guernsey (SG Kleinwort Hambros Bank (CI) Limited) and Gibraltar (SG Kleinwort Hambros Bank (Gibraltar) Limited) Consequently, the information communicated and any offers, activities and financial information presented do not concern these entities and may not be authorized by these entities or adapted in these territories. Further information on the activities of Societe Generale's private banking entities located in the United Kingdom, Channel Islands and Gibraltar, including additional legal and regulatory information, is available at www.kleinworthambros.com.